Starting and running a business can be incredibly rewarding, but it also comes with its fair share of challenges. One of the most common hurdles is managing your finances effectively. That's where a fractional CFO comes in.

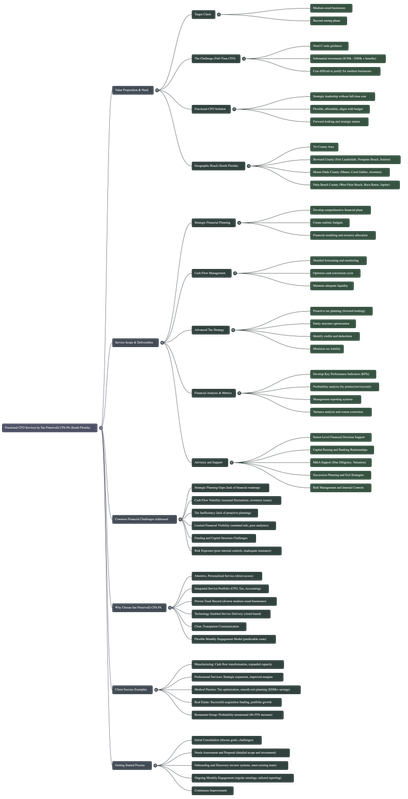

A fractional CFO provides expert financial guidance on its terms. Unlike a full-time CFO, who is permanently employed by your company, a fractional CFO offers their services on a part-time or project basis. This means you can access the expertise and insights of a seasoned financial professional without the expense of a full-time hire.

- A fractional CFO can help you with a variety of tasks, including:

- Formulating a sound financial plan

- Analyzing your financial statements

- Pinpointing areas for improvement

- Securing capital

- Managing your cash flow

By bringing in a fractional CFO, you can ensure that your finances are in good hands. This will allow you to focus on what you do best – growing your business.

Demand Part-Time CFO Solutions for Its Growing Business|

As your business scales, the demand for experienced financial guidance increases. A full-time CFO might not be feasible at this stage, but that doesn't mean you have to handle complex financial matters independently. Part-time CFO solutions offer a flexible way to utilize the expertise you require without the cost of a full-time employee.

These solutions can deliver a variety of critical functions, including financial analysis, projection, transparency, and tactical advisory. A part-time CFO can help you make informed decisions, enhance your financial results, and place your business up for lasting success.

Utilizing Virtual CFO Experts

Gain a competitive edge by accessing top-tier finance expertise with outsourced CFO services. Instead of a full-time CFO, you can utilize a skilled and experienced financial professional on a flexible basis. Outsourced CFOs offer valuable recommendations on strategic planning, financial management, risk mitigation, and more.

- Optimize your financial operations with expert support.

- Boost profitability and financial performance.

- Take informed strategies based on sound financial analysis.

Streamline Your Finances Remotely

In today's fast-paced business world, having access to expert financial guidance is crucial. However traditional CFO services can be costly and time-consuming, a virtual CFO presents a flexible solution. These skilled professionals provide the similar level of expertise remotely, helping businesses with diverse needs. A virtual CFO can handle a wide range of tasks, including financial planning, budgeting, forecasting, and {tax preparation. This allows business owners to focus on their core competencies while guaranteeing the financial health of their enterprise.

Expand Your Business with a Fractional Chief Financial Officer

Are you struggling here challenges in managing your accounting? As your business expands, the need for skilled financial guidance becomes increasingly important. Introducing a fractional Chief Financial Officer (CFO) can be a effective solution to overcome these hurdles and accelerate your growth. A fractional CFO offers the perks of a full-time CFO on a part-time basis, providing essential financial insight without the overhead associated with a permanent hire.

- Benefit from their deep knowledge in areas such as budgeting, forecasting, operational planning, and risk management.

- Optimize your financial systems for increased efficiency and transparency.

- Obtain funding opportunities by presenting a strong financial position to investors and lenders.

With a fractional CFO as your guide, you can focus your time and energy on strategic initiatives while securely navigating the complex world of finance.

Virtual CFO Assistance: Dynamic Options for Each Business Phase

Starting a company is an exciting journey, but it can also be overwhelming. Finding the right financial guidance is crucial in your growth trajectory. On-demand CFO support offers a adaptable solution to help you navigate the complexities of finance. Whether you're in the initial stages, seeking to expand, or aiming for stability, customized CFO services can provide the expertise you need to thrive. From strategic planning and financial modeling to fundraising and investor relations, on-demand CFOs offer a wide range of solutions tailored to your specific needs.

- Leverage the experience of a seasoned financial professional without the commitment of a full-time employee.

- Receive valuable insights and advice to make informed business decisions.

- Optimize your financial management and increase profitability.